- Vitalik Buterin has donated to Shielded Labs, an independent organization that advances Zcash’s privacy-focused technology.

- He donated to support the development of Crosslink, a security upgrade to Zcash that adds a finality layer on top of the network, preventing rollback attacks.

Ethereum founder Vitalik Buterin has shown support for privacy-focused crypto project Zcash by donating to a company advancing the network’s security. Shielded Labs announced that the revered crypto leader had donated to its cause, with the funding being channeled to the development of Crosslink, a security upgrade that would prevent rollback attacks on the Zcash network.

https://t.co/wC7b7TmD5u

— Shielded Labs (@ShieldedLabs) February 6, 2026

Shielded Labs is an independent organization based in Switzerland that supports the development of the Zcash network. It survives on donations and has never received support from the network’s Development Fund. The organization stated:

“The contribution will be used to advance Crosslink from its current prototype stage toward a persistent, incentivized testnet and eventual production readiness.”

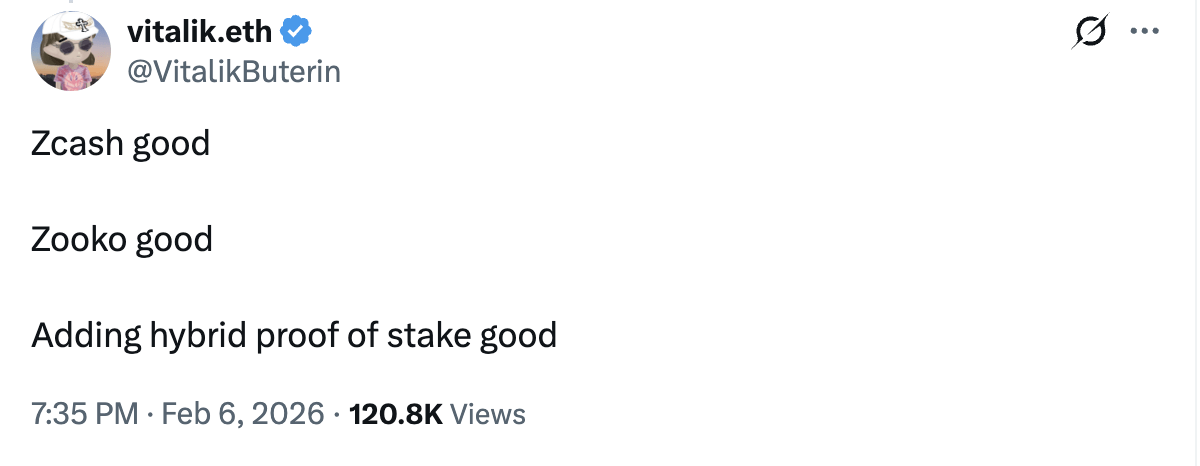

On his part, Buterin lauded the work that Zcash and its founder, Zooko Wilcox, are doing, adding that introducing a hybrid proof-of-stake consensus mechanism to the network would greatly improve it.

He added, “Zcash is one of the most honorable crypto projects with a steadfast focus on privacy. Shielded Labs’ Crosslink work will allow Zcash to be more secure and on a lower security budget, supporting its long-term sustainability.” Buterin is a long supporter of privacy initiatives. In November, he funded Session and SimpleX, two projects working on on-chain privacy, as we reported.

How Crosslink Changes ZCash

Crosslink is a protocol upgrade that adds a new finality layer on Zcash’s existing proof-of-work mechanism. This new layer would depend on proof-of-stake, making Zcash a hybrid network.

If adopted, miners would continue to add blocks, but ZEC holders would stake their coins and vote on PoW blocks, which cannot be reorganized once finalized. Theoretically, Zcash blocks can be rolled back under the current setup in a reorganization attack, although it hasn’t happened yet.

One of the big changes under Crosslink would be the economic model. Today, the miners receive 80% of the block reward for each new block, which is currently at 1.5625 ZEC per block, or $363 at current prices. Under the proposed model, they would have to split this with the stakers and validators, although the exact split has not been finalized.

Shielded Labs says:

“Stronger finality allows for shorter confirmation requirements for exchanges, improves reliability for cross-chain integrations, and provides the consistency required by applications that depend on predictable settlement. These improvements make Zcash easier to integrate into the broader crypto ecosystem while maintaining its existing security properties.”

Josh Swihart, the former CEO of Electric Coin Company (ECC), is among the top Crosslink critics. ECC is the company that founded Zcash, with Swihart becoming the network’s de facto leader after original founder Wilcox stepped back. As we reported, ECC departed from the ecosystem in January after a dispute with Bootstrap, a non-profit overseeing development.

Swihart dismissed claims that Crosslink makes the network more secure or faster, saying there are better ways to create shielded stables without adding complexity. He added that there are other upgrades on the pipeline, like Tachyon, that achieve the stated goals without compromising on the network’s usability.

While I appreciate the ideas and people behind Crosslink and ZSAs, I don’t believe either is right for Zcash.

The protocol and ZEC are elegant in their simplicity of use cases as an encrypted store of value and medium of exchange.

There is no need to add complexity.

— Josh Swihart 🛡 (@jswihart) November 23, 2025

ZEC trades at $235.60, and after a brutal week during which it lost more than a third of its value, it has gained 10% in the past 24 hours as the markets recover.

Credit: Source link