Dogecoin has spent the past few weeks grinding lower, testing the patience of bullish traders. The past 24 hours, for instance, were spent with sell-offs, with the meme coin king now down by 10% in the last trading day.

Dogecoin is now perambulating around the $0.10 to $0.11 range, a level that has repeatedly acted as a psychological battleground in past cycles. Recent technical analyses shared on X suggest that this range could determine whether Dogecoin stages another rebound or drifts deeper into weakness in the coming weeks.

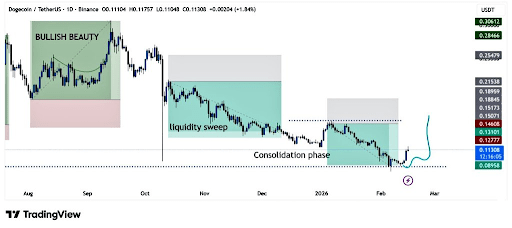

Bullish Phase, Liquidity Sweep, And Consolidation

Crypto analyst BitGuru recently outlined a structure that many traders may recognize from previous market cycles. According to his view, Dogecoin initially formed what he described as a bullish phase before entering a liquidity sweep and an extended consolidation period. The daily candlestick chart he shared shows price pushing higher earlier in the cycle, followed by a clear downside move that has been playing out since October 2025.

After that sweep, Dogecoin settled into a tightening channel of lower lows and lower highs, creating a prolonged correction range through late 2025 and into early 2026. The daily candlestick chart, which is shown below, highlights an important horizontal support region around $0.10, where price has recently reacted. From a technical perspective, this region acted as a bottom during the early February crash.

According to BitGuru, if buyers were to step in here, Dogecoin could attempt a move back toward higher resistance levels around $0.13, $0.15, and $0.19. These are all short-term price levels that can be achieved within a few hours of buying pressure.

The Weekly EMA Signal That Points To Bottoms

Another category of analysis came from Charting Guy, who approached the setup from a broader, long-term angle on the weekly timeframe. He pointed to the relationship between the 20-week exponential moving average and the 200-week exponential moving average on the weekly candlestick price chart.

Dogecoin has tended to form major cycle lows around the period when the 20-week EMA crosses below the 200-week EMA. The interesting thing is that this crossover has just appeared again. Similar crossovers in previous cycles appeared towards the end of extended bearish phases before Dogecoin transitioned into multi-month uptrends.

The weekly price chart spans from 2017 through 2026, showing how previous crosses preceded strong upward expansions. This time, Dogecoin’s price dipped to around $0.09 to $0.10 as the crossover took place.

The most important thing now is how much upside is realistic if this support truly holds. Looking at the weekly structure, a recovery above the 20-week EMA could open the door to a retest of the $0.20 to $0.25 range. Above that, Dogecoin would need better market strength, particularly from Bitcoin, to challenge the higher resistance bands around $0.30 and above.

Featured image from Freepik, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Credit: Source link