- Ethereum could bounce strongly from recent lows if it follows previous bullish cycle patterns.

- Analysts predicted that ETH may rally towards $4,500-$4,800 if the $3,000-$3,400 range continues to provide support.

Ethereum (ETH) has seen its price drop sharply in the past three weeks. The ETH price dropped to a low near $3,000 from a high of $4,960.

Analysts pointed out that the current ETH price movement resembles the 2020 correction. At the time, ETH fell from $490 to $308 before starting a major rally.

Analyst Cites ETH Historical Trends

As ETH begins to regain momentum, analysts are drawing comparisons between the 2020 market reset and the 2025 drops. They aim to determine the future price trajectory of the leading altcoin.

Crypto analyst Galaxy on X noted a sharp rally in Ethereum’s price after both events. According to Galaxy, the ETH price bounced back strongly in 2020 after hitting a low of $308.

In a similar playbook, ETH, which fell to $3,064 in November 2025, is now trading above $3,500. Therefore, Galaxy predicted that the ETH price could repeat the 2020 pattern to hit new highs.

Moreover, ETH has found a key support between the $3,000 and $3,100 levels. As seen in the previous cycles, a clear hold above support could lead to a strong Ethereum price recovery.

Another crypto analyst, Cas Abbe, also cited Ethereum’s bullish historical patterns. The analyst posted an Ethereum price chart that showed a Q2 2025 dip to around $1,800, followed by a roughly 55% rally to $2,800.

Abbe, therefore, suggests the recent ETH dip toward $3,000 is a similar “fakeout” setup for a major price rebound.

Popular crypto analyst Lark Davis further noted that ETH is still holding a trendline support, formed since April 2025, around $3,000.

This is in addition to resistance from the 20 EMA, and an impending MACD golden cross indicating bullish divergence.

What Next for Ethereum?

Given the bullish MACD and historical patterns, the ETH price looks set for further rallies. At press time, ETH was trading at $3,520, with a 24.2% jump in daily trading volume to $39.8 billion.

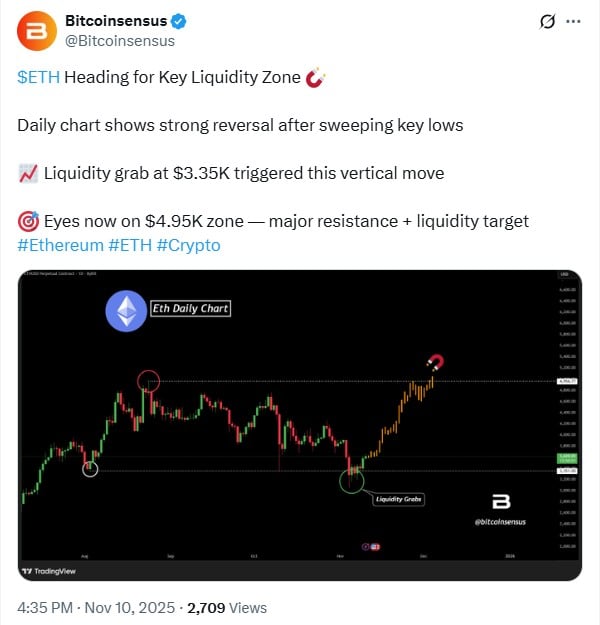

Analyzing the daily ETH price chart, Bitconsensus identified the $4,950 zone as the next key liquidity target.

This implies that as ETH moves upward, it is likely to attract price action toward this level. This is where traders expect a reaction, either a breakout above or a reversal back down, due to the concentration of orders.

Meanwhile, PRIME X added that Ethereum whales have been buying ETH at around the $3,200 price level, likely viewing it as an attractive entry point. This behavior often occurs during price dips, as whales capitalize on lower prices to build larger positions.

According to PRIME X, ETH could rally towards $4,500-$4,800 if the $3,000-$3,400 range continues to provide support.

In a recent update, we covered analyst Joseph Young’s projection that the Ethereum market capitalization could climb into the trillions.

Moreover, JPMorgan announced that it invested $102 million in BitMine, as featured in our recent coverage. This investment indicates continued institutional exposure to Ethereum despite market fluctuations.

Recommended for you:

Credit: Source link