- Data has confirmed a rise in whale activities, as transactions for meme coins like Floki dominate a Santiment-compiled list.

- Whales have also shown interest in projects like SaveDAI, MakerDAO, and others.

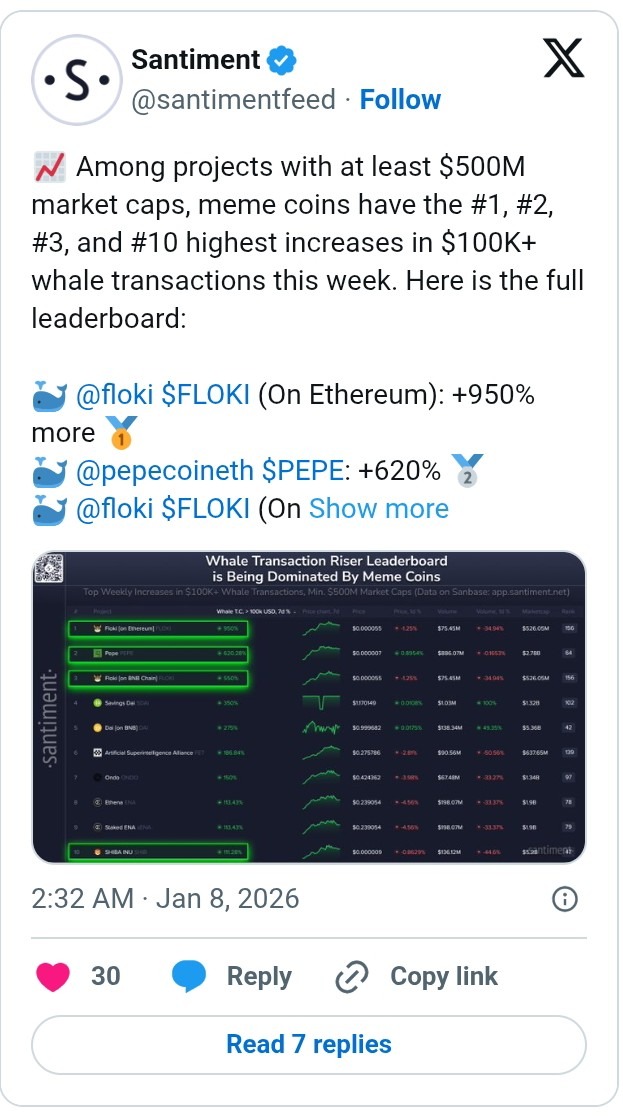

Data analytics platform Santiment has compiled a list of crypto tokens with at least $500 million market caps that have witnessed significant whale activity this week. In the list, we discovered the dominance of meme coins, suggesting rising demand and imminent bullish reversals.

Floki, Pepe, and Shiba Inu Shine

According to Santiment, Floki (FLOKI) on Ethereum had the most whale transactions, with over a 950% increase from the previous week. This was followed by Pepecoineth (PEPE), which also witnessed a 620% surge within the period. The third slot was occupied by Floki on BNB with a more than 550% surge. The fourth meme coin on the list was Shiba Inu (SHIB). This meme coin was the 10th crypto project with the highest whales transaction last week.

CoinMarketCap data shows that the meme market is responding to this rising demand. The price of Floki, for instance, has risen by 31% in the last seven days. Apart from Floki, Pepe, the third-largest meme coin, has also surged by 47%. Following this trend, Shiba Inu has solidified its position as the second-largest meme coin with a market cap of $5 billion. In the last seven days, the asset has surged by 22%.

Santiment’s data also discloses that whales have shown interest in non-meme cryptos, including SaveDAI. Within this week, whale transactions for this asset have increased by 350%. MakerDAO on BNB has also had a 275% increase in similar transactions. Amidst the backdrop of this, Bitcoin (BTC) has been able to rally past the $89k level after multiple failed attempts in the latter part of 2025.

More Details on the Rising Meme Coins

Reviewing the Santiment’s data, we discovered that the strongest gains are coming from assets within the Solana (SOL) and Ethereum (ETH) ecosystems. Both SOL and ETH have printed weekly gains of 7% and 3%, respectively. Bitcoin’s recent performance is also reported to have been motivated by the substantial rise in aggregated Open Interest, which reached $31.44 billion.

Head of research at crypto market-making firm Caladan, Derek Lim, has, however, cautioned that meme coins may sometimes appear unpredictable, and this move might not be a market shift.

I will hesitate to read this as the market is shifting into a more risk-on mode. Meme coin pumps can be relatively easily manufactured by a multitude of factors, such as low liquidity and extremely low float, so they may not necessarily represent any larger shifts in momentum/attitudes with regard to the broader market.

Credit: Source link