Join Our Telegram channel to stay up to date on breaking news coverage

Jim Chanos has confirmed that his investment firm Kynikos Associates has unwound its short position on Michael Saylor’s Strategy, a move one analyst said could signal the end of the bear market for Bitcoin treasury firms.

Chanos, a veteran investment manager who is best known for shorting Enron before its collapse in 2001, said the move came after Strategy’s share price plunged 50% from its peak, and with its market Net Asset Value (mNAV) now compressed to 1.23x.

As we have gotten some inquiries, I can confirm that we have unwound our $MSTR/Bitcoin hedged trade as of yesterday’s open. pic.twitter.com/lgrWNy35H8

— James Chanos (@RealJimChanos) November 8, 2025

Strategy Premium Expected To Compress Even More

MSTR’s implied premium, which is its enterprise value minus the value of its 641,205 BTC reserves, has dropped from around $70 billion in July to $15 billion now.

In a screenshot of a note sent to investors that was shared on X, Chanos said his firm expects Strategy’s premium to compress even more as the Bitcoin treasury company “continues to issue common equity.”

But he recommended “letting others chase the last leg of the trade as MSTR inevitably marches towards a 1.0x mNAV.”

Analyst Says Bitcoin Treasury Bear Market Is Nearing End

Responding to Chanos’s post, The Bitcoin Bond Company CEO Pierre Rochard said “the Bitcoin treasury company bear market is gradually coming to an end.”

”Expect continued volatility but this is the kind of signal you want to see for a reversal,” he added.

I doubt that’s a sign the bear market is over. That was a spread trade. The loss of the Strategy premium is a bearish signal. It likely indicates a discount is next.

— Peter Schiff (@PeterSchiff) November 9, 2025

But Bitcoin permabear Peter Schiff took issue with Rochard’s post, saying he doubt it signals the end of a bear market.

The company’s declining premium “is a bearish signal,” he said, adding that it “likely indicates a discount is next.”

Rochard soon fired back.

“With all due respect Mr. Schiff, given your track record of being bearish on Bitcoin since 2011, please forgive us if we put you in the counter-signal bucket with Mr. Cramer,” he said.

Saylor Hints At Another Strategy Buy Despite MSTR Downtrend

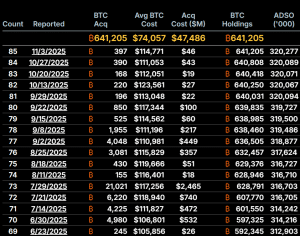

Strategy started buying Bitcoin back in 2020 as part of a corporate treasury plan and is now the largest digital asset treasury (DAT) firm globally, with Bitcoin Treasuries showing its BTC holdings are valued at more than $67 billion.

Strategy BTC holdings (Source: Bitcoin Treasuries)

The company is sitting on an unrealized profit of over 43%.

Strategy Doubles Down On Bitcoin

Despites its plummeting share price, Strategy has continued to grow its Bitcoin reserves in recent weeks, albeit at a slower pace than earlier in the year.

Recent Strategy BTC buys (Source: Strategy)

In a post on X yesterday, Strategy’s founder Michael Saylor posted a screenshot of the SaylorTracker chart with the caption “₿est Continue.” Similar posts by Saylor have invariably been followed by announcements of a new BTC buy.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link