- Zcash’s parabolic surge aligns with multiple bearish signals, including a widening wedge pattern and weakening market structure.

- On-chain data shows extreme retail dominance and fading short-squeeze momentum, increasing the risk of a sharp trend reversal.

The Zcash (ZEC) rally, which has been steadily climbing for the past two months, has finally reached a point that has many market participants starting to worry.

As of press time, ZEC is trading at about $672.73, up 0.75% in the last 4 hours and a 23.52% surge in the last 24 hours. Such rapid movements may seem exciting, especially after its nearly 2,000% surge since September. However, on-chain analyst CryptoOnchain sees a series of warning signals that are hard to ignore.

Retail Euphoria Signals Trouble Ahead

CryptoOnchain assesses that ZEC’s daily chart is beginning to form an ascending broadening wedge pattern. This pattern often appears when volatility widens and buying power begins to weaken.

Not only that, but this condition often signals the beginning of a fairly violent reversal. Furthermore, ZEC’s recent parabolic rally is inextricably linked to a massive short squeeze. In the last 24 hours alone, more than $36 million in short positions was liquidated. This kind of forced buying can indeed cause prices to spike, but it’s usually short-lived.

Derivative movements also reflect a similar picture. CoinGlass data shows a volume surge of 82.31% to $9.84 billion, while open interest rose 34.12% to $1.28 billion. This level of activity sometimes indicates that more traders are trying to ride the wave of momentum, even though the market is already somewhat heated.

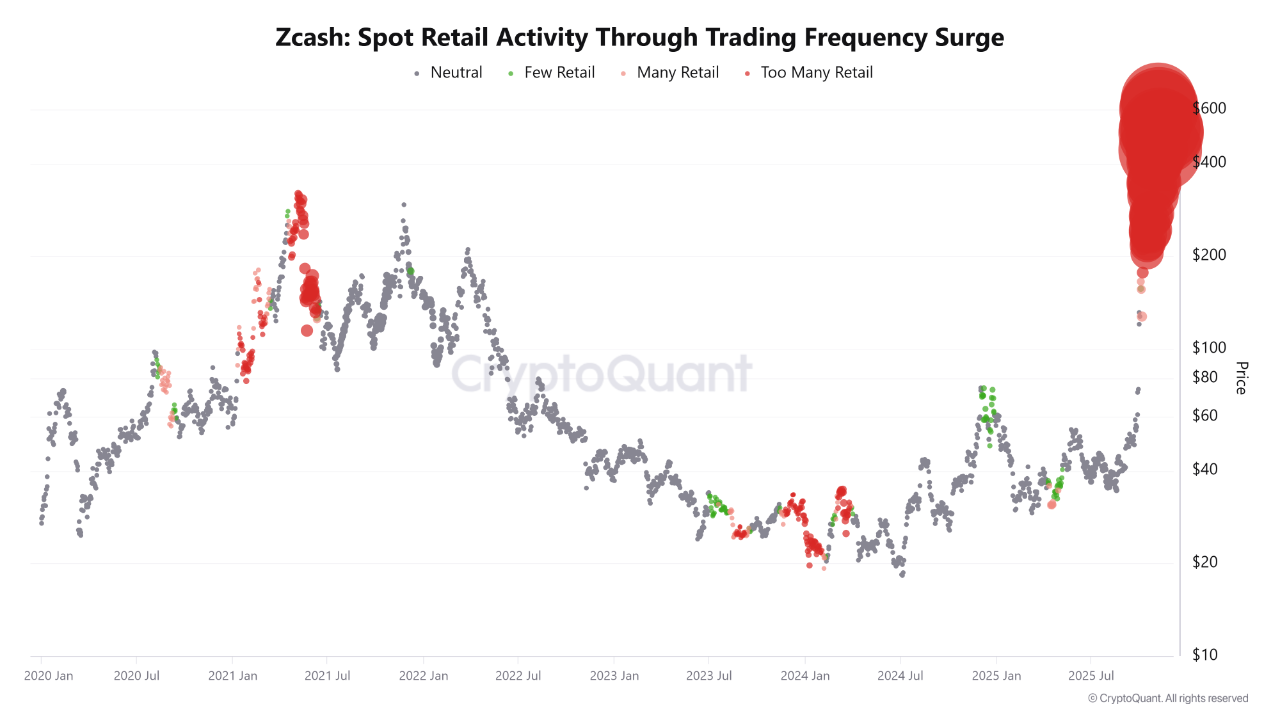

Furthermore, CryptoOnchain highlights that the final phase of the ZEC rally is now dominated by retail. The “Too Many Retail” signal on the Spot Retail Activity metric is flashing red, a classic sign that usually appears when the market is at its peak.

It may sound cliche, but history often shows that when retail euphoria peaks, the calm rarely lasts long.

Zcash Developments Gain Momentum in Corporate Moves

On the other hand, CNF previously reported that a Nasdaq-listed biotech company is rebranding to shift its focus to a ZEC-based digital asset strategy.

The company, now known as Cypherpunk Technologies, has even begun accumulating ZEC as part of a new treasury strategy, while continuing its biotech operations through a subsidiary.

Electric Coin Company (ECC), the company behind Zcash, also drew attention with its latest update. In early November, the group unveiled its Q4 2025 roadmap, outlining enhancements for the Zashi wallet, including temporary transparent addresses and an address rotation feature designed to improve privacy and usability.

There is also a Pay-to-Script-Hash multisig feature for the Keystone wallet, which increases the security of development funds and improves ecosystem governance.

However, CryptoOnchain warns that the combination of a bearish technical pattern, the exhaustion of short squeeze pressure, and retail dominance creates a kind of “triple threat.”

If the price of ZEC breaks below the support line of the wedge pattern, analysts say the rally could reverse course more quickly than new traders might imagine.

Credit: Source link